Dumpster Rentals in Indianapolis, IN

Sat: 8 am - 5 pm EST

Rent a Dumpster in Indianapolis to Clean Up More for Less

Our low-cost roll off containers are so affordable you’ll probably come in under budget. We deliver anywhere in Indianapolis and bundle your rental period, drop-off and pickup costs so there are no unpleasant surprises.

With us, you'll enjoy:

- Easy online ordering.

- A variety of roll off container sizes.

- Flexible rental periods to fit your job.

Household & Construction Dumpsters

These roll off dumpsters can be used for common household and commercial projects, including home cleanouts, remodeling, general construction and demolition.

50-70 Trash Bags

- Attic cleanouts

- Light demolition

- Concrete disposal

80-100 Trash Bags

- Bathroom remodels

- Roofing repairs

- Festivals

110-130 Trash Bags

- Partial home cleanouts

- General construction

- Roofing projects

170-190 Trash Bags

- Office cleanouts

- Home additions

- Decluttering before a move

230-250 Trash Bags

- Full home cleanouts

- Complete home remodel

- Commercial renovations

*Disclaimer: All dumpster dimensions may vary slightly but volume is accurate. Prices and availability are subject to change without notice. Capacity estimates are based on the volume of a 33 gallon trash bag.

How It Works

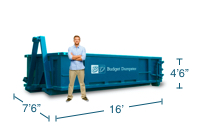

1. Choose a size and delivery spot. We require 60 feet of space in a straight line and 23 feet of vertical clearance.

2. Prepare for delivery. Remove any vehicles, materials or low-hanging obstacles to ensure we can deliver your dumpster and to avoid a trip fee.

3. Fill up your dumpster. Remember to keep your included weight limit in mind to prevent overage fees.

4. Schedule your pickup. To ensure pickup and avoid a trip fee, your dumpster must be accessible and only contain approved debris piled no higher than the sidewalls.

Toss Debris Stress-Free With an Indianapolis Dumpster Rental

We admit junk removal can be a hassle. That’s why we streamlined the process. Boutique remodels at The Fashion Mall are simple with a roll off dumpster on-site. We’ll recommend the best bin for your debris, then drop it off close to your work area. Picking up trash along Indy’s Cultural Trail? With us, you can work at your own pace. Restoring your home in Irvington’s historic district? Our general rental periods will make your job a breeze. When you’re finished loading, simply schedule a pickup online. We’ll haul away the mess ASAP. Call 317-308-4867 to rent a dumpster.

Why We’re Top-Rated

We make it easy to get rid of debris. Have a large reno on your hands? Order multiple dumpsters at once or schedule empty-and-return service to keep working without delays. Completing a weekend DIY project? We’ll walk you through the dumpster rental process so you know what to expect.

What Materials Can Our Dumpster Rentals Take?

Accepted Household Debris

- household junk

- carpet

- flooring

- appliances

- electronics

- furniture

- mattresses & box springs

- fixtures

- yard waste

- stumps

Accepted Construction and Heavy Debris

- construction debris

- wood & drywall

- roofing materials

- concrete

- block

- brick

- dirt

- asphalt

*Please call your sales representative to learn more about disposing of specific materials, as well as any items we cannot accept.

by Joseph Lee

April 15

Not just a dumpster company

Read moreby John Ferns

April 15

Austin was over the top!

Read moreby OZ

April 14

Everything went as prescribed.

Read moreFrequently Asked Questions

Do I need a permit for my dumpster rental?

You don’t need a permit if we drop off your dumpster at your jobsite, driveway or other piece of private property. But you must have a Right-of-Way Permit from Indianapolis if you want us to deliver your roll off container to the street. This is especially important if your dumpster blocks the sidewalk or impedes traffic. Contact us for more help with permits and an expert placement recommendation.

How much is it to rent a dumpster?

Our roll off dumpster rental prices match your budget and project, so you only pay for what you need. Dumpster prices depend on your location, dumpster size, debris type, debris weight and rental period. But typically, it costs between $217 to $1,040. You can get a quote online now or reach out to our team. We’ll learn the details of your project and provide you with personalized dumpster rental prices.

How should I prepare for my roll off dumpster delivery?

Make sure the drop-off location is clear and accessible before your dumpster rental arrives. If you’re working at home, move cars out of your driveway and open any entry gates to your property. You can also lay down plywood to protect your pavement from scrapes and scratches. On construction sites, ensure the delivery area is away from equipment and other potential obstacles. The spot should also be wide enough for our truck to fit through. When you rent a dumpster from our team, we’ll share more delivery tips to make your junk removal project seamless.

Looking for a dumpster closer to home? Find your location below:

Become a Hauling Partner

Want more business? Work with us and you can sell more dumpsters without the added overhead. Learn more about partnering with Budget Dumpster.